Category: Health Care Cost

-

Educating Employees on Increasing Healthcare Costs

Health care costs in the United States continue to rise, increasing pressure on both employers and employees. Organizations that provide health benefits must balance growing expenses with transparency and trust from their workforce. Clear, compassionate communication is key to helping employees understand and navigate these rising costs. Consider these strategies: Craft messaging that is clear,…

-

The Rising Cost of Prescription Drugs: Smart Ways to Save

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save…

-

2026 Medical Cost Outlook

PwC’s latest annual analysis forecasts that group health insurance costs will increase by 8.5% in 2026—the third straight year at this elevated trend. This sustained rise means health care expenses are now similar to those seen 15 years ago, after a brief dip post-pandemic. Researchers gathered data from actuaries at 24 major U.S. health plans,…

-

Reducing Rising Healthcare Costs in 2025

Healthcare costs are projected to rise significantly in 2025. To mitigate these increases, consider these tips: Know Your Plan: Take time to review what your health plan covers—and what it doesn’t—to avoid unexpected costs. Understand your health plan’s coverage, including deductibles, co-pays, and out-of-pocket maximums. Utilize In-Network Providers: Receiving care from out-of-network providers can dramatically…

-

Key Factors Driving Health Care Cost Increases in 2025

Health care expenses are expected to rise significantly in 2025, with projections indicating a 7%-8% increase. This aligns with similar trends in 2024, showcasing the cumulative impact of ongoing cost growth. Below are the primary drivers of these increases: GLP-1 Medications: Glucagon-like peptide-1 drugs typically require long-term use to deliver intended health benefits. Currently, 6%…

-

ER vs Urgent Care: How to Choose the Right Care for Your Medical Needs

All too often, illness or injury appears out of the blue: You wake up in the middle of the night with intense abdominal pain. Or your baby spikes a high fever on the weekend. These situations are stressful and it’s hard to think when you’re under stress. But you need to decide where to go…

-

Understand Your Spending Power: What You Can Buy with Your FSA, HSA, or HRA

Medical expense accounts can help you save on all kinds of healthcare costs. Here are some you may not know about yet. HSA, FSA, and HRA can typically be used for: Expenses that might be covered, but check your plan: Important Considerations: Additional Tips: By understanding the nuances of HSAs, FSAs, and HRAs, you can…

-

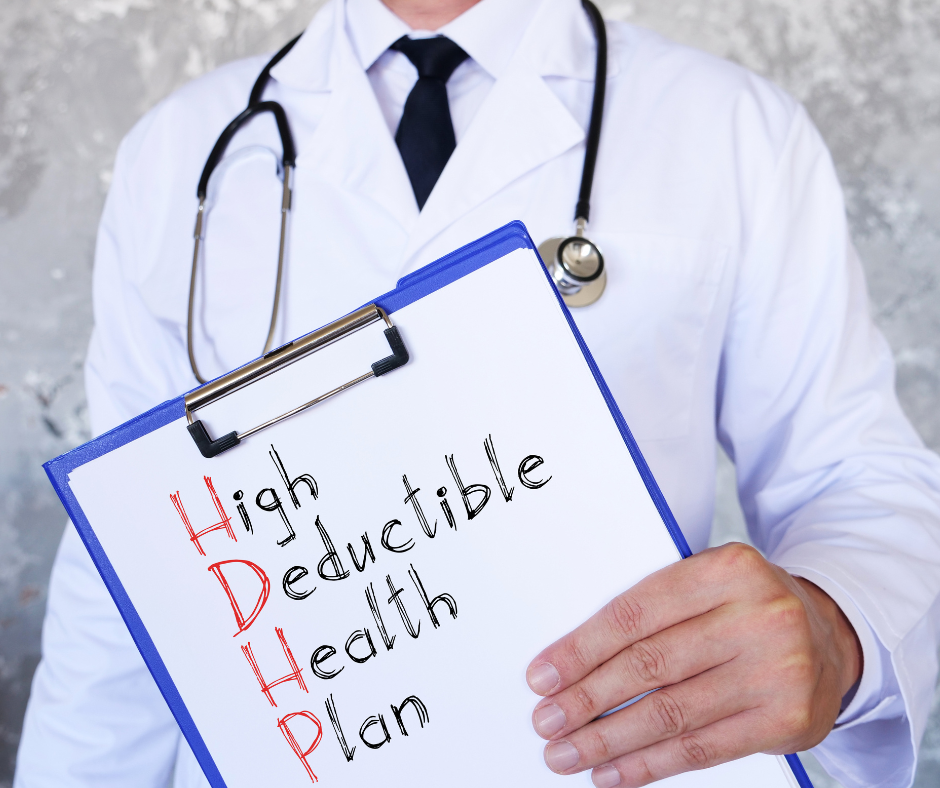

Benefits 101: What Is an HDHP?

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs: What is an HDHP? An HDHP is a health insurance plan with a higher deductible than traditional plans. This…

-

Up and Away – Healthcare Costs Are Taking Off

Healthcare costs, and consequently employee health benefit costs, have been growing at an alarming rate in recent years. The U.S. as a nation spends more on health care than any other developed country but has worse health outcomes. How is this possible? Four Key Factors Driving U.S. Healthcare Costs: Aging Population Healthcare gets more expensive…

-

ER vs. Urgent Care

All too often, illness or injury appears out of the blue: You wake up in the middle of the night with intense abdominal pain. You stumble while carrying groceries up a flight of stairs and can no longer put weight on your swollen ankle. Or your baby spikes a high fever on the weekend. These…

-

Transparency Rules Require Plan Sponsors to Act Now Before July 1 Deadline

The Departments of Health and Human Services, Labor, and Treasury (the Departments) released Transparency in Coverage (TiC) rules in late 2020 that will require fully insured and self-funded plan sponsors of non-grandfathered group health plans to make important disclosures about in-network and out-of-network rates beginning July 1, 2022. To be ready to meet that deadline,…